Most people think a deal is about how much cash you need now and how much later, and these are the only parameters they consider. It’s probably because we are used to buying property, and most people know how to buy a house: cash plus mortgage. That’s it.

However, business deals have many more parameters around how you do the cash now and the cash later. When someone says they want a million dollars for their business, don’t be dismissive. Instead, say, “Okay, let’s see how we get you to your million dollars.”

This is a very powerful sentence; you are not owning the million dollars (that is theirs), but you are offering a collaborative approach to reaching a solution they want. This is the way to do deals with owner-managers and entrepreneurs. Collaborate, don’t compete; keep ego intact and work together; put your chair on their side of the desk.

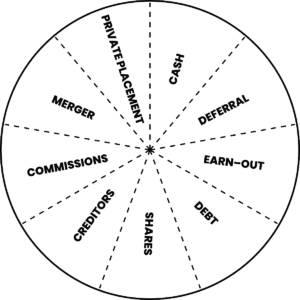

The “Deal Pie”

You can then work towards their $1 million with a number of items. We call it a “deal pie,” like a pie chart with the components of the $1 million broken out. You can have:

- Cash – This can include cash extracted from the business at purchase and given to the existing shareholders.

- Deferral – This is money paid over a period of time.

- Earn-out – This is linked to some future performance or success.

- Debt – This is like a mortgage borrowed against the business. (Many M&A courses teach you to use working capital finance like factoring or invoice finance…do not! It is dangerous, lazy, and simple, and a real wealth hazard—there are much smarter ways to do it.)

- Shares – You can pay the old owners with a share in the company, or you can use shares in a holding company as payment.

- Creditors – You can do debt-for-equity swaps or get creditors to support the purchase.

- Commissions – You can switch suppliers and get kickbacks for long-term contracts.

- Merger – You can buy a distressed company for $1 and merge this into a target company, which gives you an equity foot in the door.

- Private Placement – You can get an investor to support a cash component if you have the rest of the deal agreed (but this should only be for large solvent businesses).

In the Harbour Club course, we go through twelve different deal structures (at the time of this writing), showing how you can buy businesses without using cash up front. These are designed to cope with everything from the well-established, profitable, debt-free business right down to the completely distressed basket case that’s about to close its doors and send everybody home. We cover the whole spectrum of motivating opportunities.

The deal pie sits somewhere in the middle. It’s a way of structuring a deal so that you can acquire a decent business. I wouldn’t call it a great business, but it is a good business that’s probably generating profits, has some assets, and offers a good opportunity to build something for the future.

Choose Your Slices of Pie

There are many different parts to the deal pie, but you don’t have to use all of them because it can get overcomplicated. Just use the ones necessary to get the deal closed.

When I bought the small IT company mentioned earlier for $1, I ended up merging it with a larger IT company for a 35% stake in the new enlarged business. I then used a combination of shares, earn-out, and deferral to take my stake up 87.5%. The small acquisition effectively became the currency for a bigger deal.

In that situation, it was about using a structure instead of just focusing on the price. “How much do you want for your company, and how do we structure this?” You no longer have to just think in terms of how much money they want, how much of that needs to be up front, and how much you need to borrow from the bank!

When you’re buying a company, there’s so much more to play with. You’ve got the shares in the company—you can keep them as a shareholder, you don’t have to buy it all. You could buy just 80%. You need to have good contracts in place if you have another shareholder because you need to be able to control the profits, the sale of the business, and a few other things that we cover in the Harbour Club course. Lawyers love huge shareholder agreements, but you can cover all the important things in a couple of pages.

You can use deferral, paying money over time. You can use earn-out. So, don’t think of deals in one or two dimensions—think about how to solve the problem with a multifaceted approach.

Money Up Front?

What if they insist on having some money up front? Well, then maybe it’s not the deal to do. If they insist on money up front, I always say, “Look, if you’ve got somebody who’s willing to give you this money now up front, take it! Go for it! If you don’t, here’s my deal. Here’s the deal that we’ve got on the table.”

You’d be surprised how many times, when you tell them that, you can actually get the deal done for no money up front. You’re a path of least resistance, you’re a simple person to do a deal with, and there are very few simple people to do a deal with out there. By focusing on the structure instead of the price, you can often get deals done that no one else can and then swoop in and run off with all the prizes.

Next time, I’m going to share a case study with you and dive deep into a deal that Steve, a Harbour Club member, did that could have gone either way, except for what he learned at the Harbour Club. Join me then to learn from Steve and see how it turned out.

Let’s Connect!

HarbourClubUSA.com

Unity-Group.com